ARR multiples are all the rage these days. Formerly reserved for fast-growing SaaS companies, they are now are widely used to express valuations of all types of SaaS businesses: private & public, small, medium & large companies, high-growth & shrinking ones, cash-burning & high-profit,…

Top drivers of SaaS ARR multiples:

ARR & Revenue growth

Quality of Revenue

Capital Efficiency

So far, so good. However, few founders know what’s behind these multiples and how acquirers actually look at their business.

The majority of SaaS buyers in the private market are private equity firms or strategics backed by private equity firms (60.2%).

Especially in lower ARR regions <$5M, chances of selling to a strategic for a steep multiple are extremely low.

Common reasons:

Lack of robust operational infrastructure/processes,

Relatively small customer base,

Lack of Differentiation,

Weak KPIs / Financial performance,

…

Private equity firms all have one thing in common: they want to make more money from an acquired SaaS company in the medium to long term than they have spent on it. It's that simple.

There are countless approaches, but you can narrow it down to two main strategies to achieve this:

Through profits generated by the business over the holding period,

AND/ORBy selling it for a higher price at the end of the holding period.

Unless they are serial acquirers looking to accumulate cash flows, the focus is usually on the latter: increasing the value of the acquired company over the holding period, for example by..

Accelerating growth and optimizing KPIs,

Improving operational efficiency,

Enhancing the product,

…

Most M&A deals are structured as Leveraged Buyouts (LBOs), which means acquirers are using a substantial amount of debt to finance the acquisition, with the target company's assets serving as collateral for the borrowed funds. For smaller transactions, the debt to (acquired) EBITDA ratio is ~ 4-4.5x on average.1

One of the main metrics to measure private equity fund performance is the Internal Rate of Return (IRR).

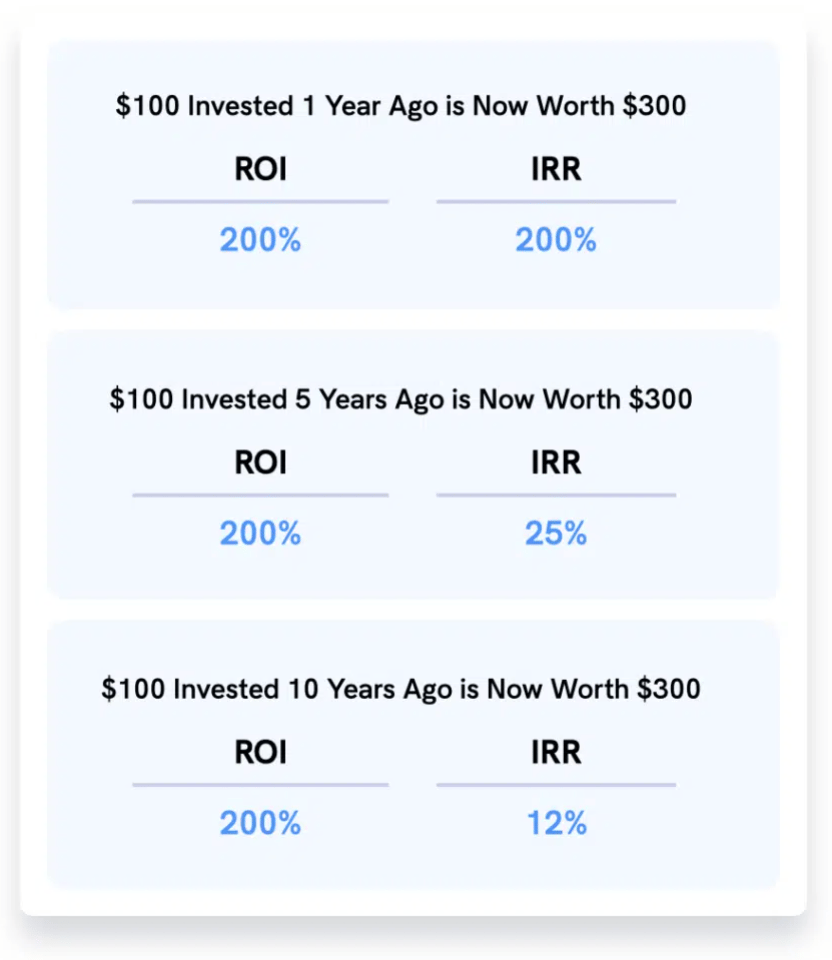

Unlike ROI (which indicates the total return on an investment), IRR takes into account the time value of money. Check out the example below.

Proceeds by the end of the investment period are always the same (i.e. identical ROI). However, the first investment returned the same amount in a much shorter time → significantly higher IRR.

IRR represents the annualized rate of return generated by an investment over a projected holding period. Or in other words: ROI discounted for future cash flows. See below the formula (in Excel you can simply use the IRR or XIRR function).

NPV = Net Present Value = 0

T = Number of time periods

Ct = Total net cash flow during period t

C0 = Total initial investment costs

The average holding period of assets acquired by PE firms has recently been around 5-6 years.2 PE companies aim for an IRR of ~25%.3

You need to roughly 3x the investment in 5 years to get an IRR of ~25%.4

Let’s look at a simple example without debt:

(For simplicity reasons, we take EBITDA instead of cash flow)

You acquire a SaaS business doing $4M ARR with $1M EBITDA for $8M (= 2xARR = 8xEBITDA),

You are able to grow ARR at 15% CAGR over the holding period and keep EBITDA margin stable at 25%.

At the end of a 5y holding period, you have a business with roughly $8M ARR and $2M EBITDA.

You sell the business for the same EBITDA multiple you bought it for (8x), i.e. for $16M.

If you add annual EBITDA over the 5y period (~$8M) and the exit price of $16M, you come up with ~$24M → 3x investment. IRR = 25%! ✅

Let’s now take a different example using debt:

You acquire the same business by using $4M of your own money and $4M of debt (4x Debt-to-EBITDA ratio).

You are able to grow ARR at 5% CAGR over the 5y period and keep EBITDA margin stable at 25%.

You repay the debt in full over the holding period. $800k/y (simplified without interest rate).

You sell the business for 8xEBITDA after 5y (~$10M).

→ EBITDA summed over the holding period: $6M

→ Debt repayment: -$4M

→ Sale: +$10M

= $12M → 3x investment. IRR = 25%. ✅

As you can see, leveraging transactions through debt allows PE firms to amplify their returns, or - as in the example shown - achieve the same returns with less effort (while committing a smaller portion of their own capital).

As a founder, you can do the math yourself. Just take your financial forecast and play around with the numbers. Rule of thumb: Investors tend to have somewhat more conservative hypotheses than you do.