Figma's recent S-1 filing has been making waves, and rightfully so. The company is undeniably a PLG powerhouse with impressive metrics, and it's refreshing to see the IPO market opening up again after years of drought.

As someone who spends their days validating founder-reported SaaS KPIs, I couldn't help but dig deeper into Figma's headline 132% Net Revenue Retention figure.

What I found was a masterclass in selective metric reporting that every SaaS founder should understand - both to avoid being misled by competitor benchmarks and to ensure their own KPI reporting passes investor scrutiny.

The Headline vs. The Fine Print

What Figma Reports: 132% Net Dollar Retention as of March 31 2025

The Fine Print: Figma’s NDR calculation includes only customers who had >$10k ARR twelve months ago and still have >$10k ARR today.

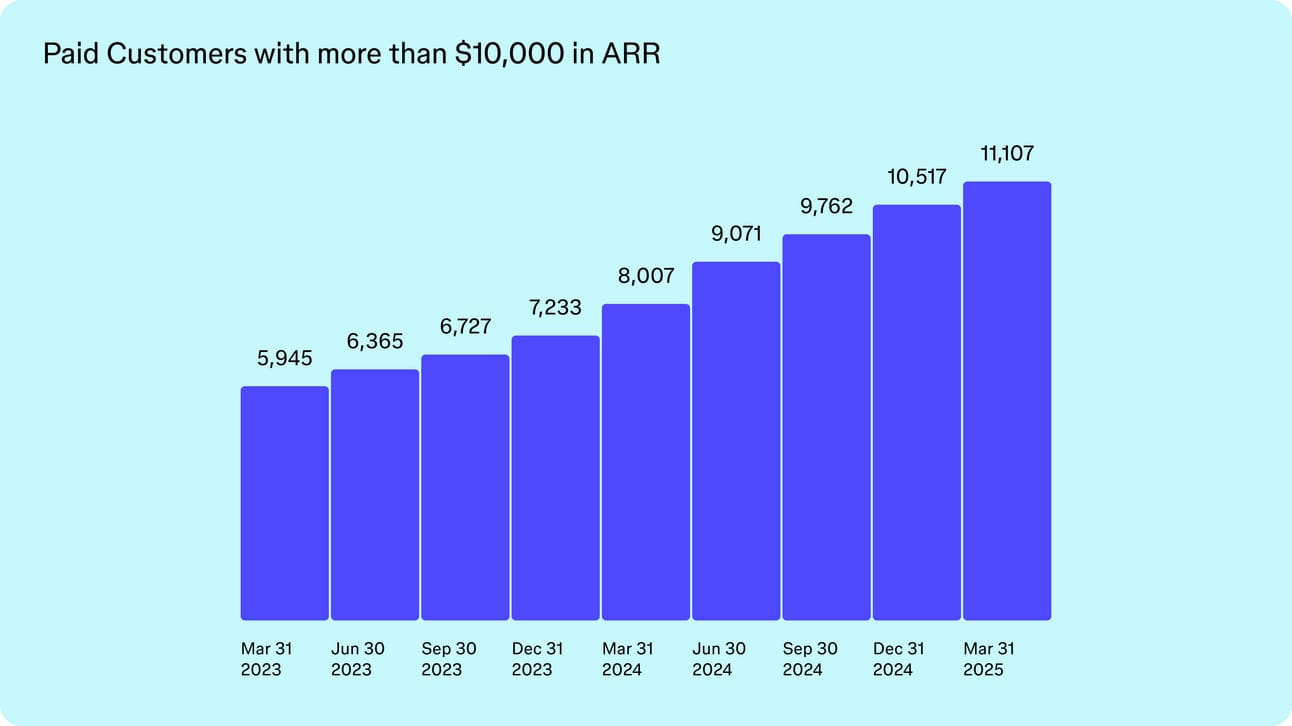

They report 11,107 customers above the $10k threshold as of March 2025 - about 2.5% of their 450k total paid customer base. While we don’t know how many of those also met the >$10k criteria a year earlier (as required by the NDR definition), I used the 11,107 figure as a proxy for this analysis. This group accounts for 64% of total ARR.

This methodology systematically excludes any >$10k customer who churned or downgraded below the $10k threshold, plus 97.5% of their entire customer base.

While not technically wrong, it’s a narrow slice of customers - and likely not what most people picture when they hear “Net Revenue Retention”.

Reverse Engineering the Real NDR

Given Figma's 46% total revenue growth (YoY), I decided to work backwards and estimate what their true, blended NDR might look like across all customer segments.

Step 1: Calculate the >$10k cohort's contribution

This segment represents 64% of ARR with 132% NDR

Their growth contribution: 64% × 32% = 20% of total growth

Step 2: Find the gap

Total company growth: 46%

Growth from >$10k cohort: 20%

Remaining growth to explain: 26%

Step 3: Decompose the remaining growth This 26% must come from:

New customer acquisition (typically 20-25% for high-growth PLG companies)

Performance of the <$10k segment (36% of total ARR)

Step 4: Calculate true blended NDR

If new customers drove ~20-25% of growth

Then existing customers across all segments drove only ~25% total growth

Given that the <$10k segment likely has much lower retention (I modeled 90-100% based on typical SMB behavior - but could be even lower)

True blended NDR ≈ 115-120%

⚠️ Note: This is my back-of-the-envelope calculation based on public data - if you spot any errors in my math or assumptions, please let me know.

The Reality Check

The math suggests that Figma's <$10k customers (representing 98% of their customer base) have significantly lower retention rates than their enterprise segment. This isn't surprising - it's actually quite typical for PLG companies with broad SMB adoption.

But there's a meaningful 15-20 percentage point gap between "NDR for our best customers" and "NDR for our business as a whole."

To be clear: 115-120% NDR is still very strong performance. But it's a different story than the headline 134% suggests.

Why This Matters for SaaS Founders

This analysis highlights several important lessons:

1. Always read the methodology, not just the metric How a KPI is calculated can dramatically change what it actually tells you about business performance.

2. Segment-specific metrics can be misleading Reporting only your best-performing cohort creates an incomplete picture of overall business health.

3. Benchmark comparisons require context If you're comparing your company-wide NDR to Figma's enterprise-only NDR, you're not making an apples-to-apples comparison.

4. Transparency builds trust While Figma's methodology is disclosed in the fine print, leading with the more representative metric would provide better insight into the business.

The Broader Investment/M&A Implication

From my perspective evaluating SaaS companies for acquisition, this kind of selective reporting is exactly why I never rely solely on founder-reported KPIs. Instead, I always calculate metrics myself using raw transaction data.

I've seen too many pitch decks with impressive NDR figures that fall apart when you dig into the underlying cohort performance.

If you're preparing for an exit or fundraise, consider reporting both your blended metrics and your best-performing segments. Sophisticated buyers and investors will calculate them anyway, and leading with transparency builds credibility from day one.

Key Takeaways

Figma's reported 134% NDR likely translates to ~115-120% (or lower) when calculated across their entire customer base

Selective metric reporting is common but can be misleading for benchmarking

Always understand the methodology behind any KPI before using it for comparison

Transparency in metric reporting builds trust with investors and acquirers

In SaaS, the devil is always in the details. Whether you're a founder reporting metrics or an investor evaluating them, understanding what's actually being measured is just as important as the number itself.